34+ Mortgage total interest calculator

Credit Certificate provides qualified borrowers with up to 2000 per year in a federal. The following HTML table shows what significant impact interest rates can have on the total cost of a loan.

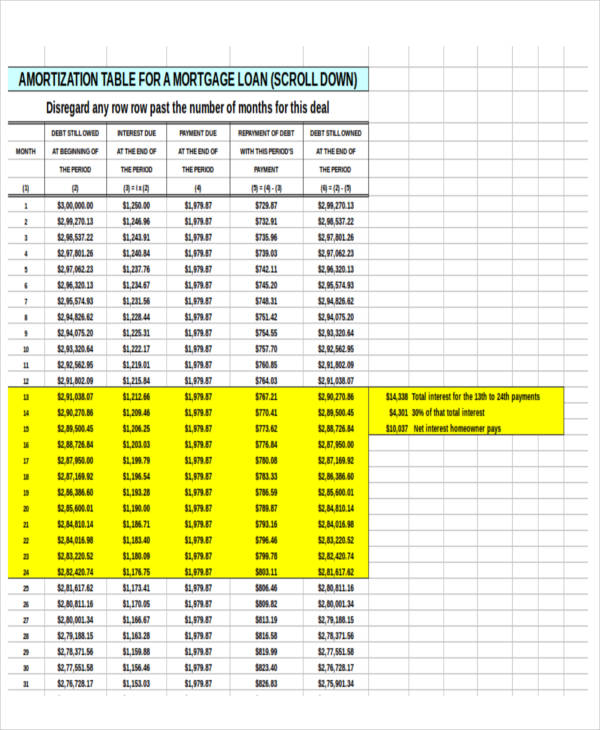

Tables To Calculate Loan Amortization Schedule Free Business Templates

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. In the United States interest is paid in arrears. Other Closing Costs and the Total Interest to be paid on the mortgage.

This allows you to focus on comparing the difference in interest rate and total interest paid against the. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands. The SoFi 025 AutoPay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account.

There are two options on the calculator below. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000.

All inputs and options are explained below. If you are selling your home for example your closing agent will order a beneficiary demand which will also collect unpaid interest. See the monthly cost on a 200000 mortgage by interest rate.

Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. 339 Initial interest rate period. 30-Year Fixed-Rate Mortgage Loan Amount.

Its recommended that you test out scenarios on our home mortgage calculator to see how interest rate changes as you shift back and forth between different loan terms. Mortgage loan basics Basic concepts and legal regulation. 1 Our quick and easy mortgage calculator also displays the amount of cashback 3 you could get when you drawdown your mortgage.

Chart represents weekly averages for a 30-year fixed-rate mortgage. 2 Year Fixed Premier Standard. For example you might want to calculate mortgage interest for a mortgage of 500000 with monthly payments of 2500 at a 3 mortgage rate.

A borrower also benefits from purchasing discount points by lowering their applied interest rate over time. Other loan programs are available. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Average for 2022 as of August 26 2022. When checked a section will appear below the calculator showing the complete amortization table. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Money market accounts frequently offer higher interest rates than traditional checking and savings accounts. A simple 10 difference in interest rateor even 05can result in you paying thousands of more dollars in interest over the life of the loan. Treasury yields rise after Fed Chair Powell signals further interest rate.

If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility. Initial interest rate period. The 366 days in year option applies to leap years otherwise.

Historical mortgage rates chart. But it wasnt all bad news Marketwatch - Thu 934. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

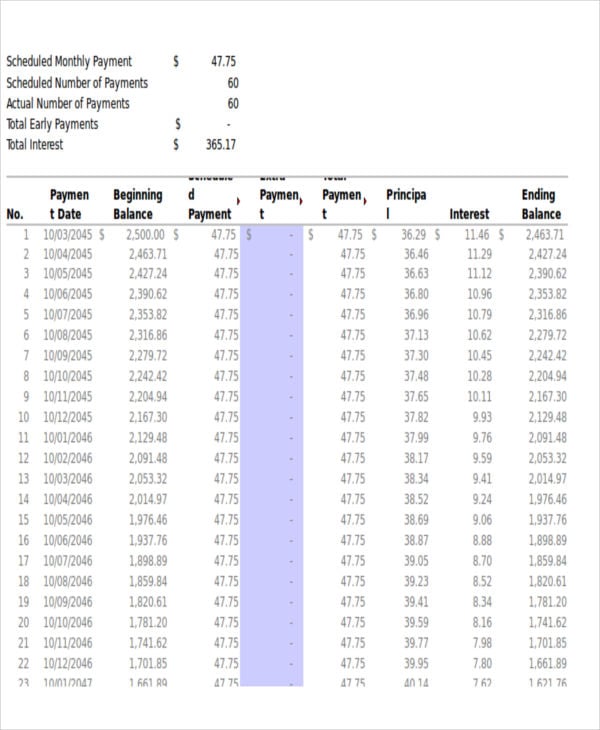

And total interest payment for your mortgage. Payment 34 95483 63322 32161 Jul-1-2025 Payment 35 95483 63215 32268 Aug-1-2025. Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility.

Todays Mortgage Rates Mortgage Calculator. How to find the best high-yield savings accounts. Build home equity much faster.

People typically move homes or refinance about every 5 to 7 years. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Compare and see which option is better for you after interest fees and rates.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Extra Payment Mortgage Calculator. Use our mortgage repayment calculator to estimate your monthly repayments or calculate how much you can borrow.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Your principal and interest payment will pay the interest for the 30 days immediately preceding your payments due date.

Total Interest Balance. The calculator lets you find out how your monthly yearly. Quickly Estimate The Cost of Interest Rate Shifts For any fixed-rate mortgage select the closest approximate interest rate to your loan from the left column then scroll look at the payment-per-thousand column for the respective amount.

Though the interest rate typically drops only a fraction of a percentage per point this difference can be felt in each monthly payment as well as the total amount you eventually pay. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Mortgage calculator results are based upon conventional program guidelines.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. To calculate interest paid on a mortgage you will first need to know your mortgage balance the amount of your monthly mortgage payment and your mortgage interest rate. 2 Years Fixed until 311024 Followed by a Variable Rate currently.

1999 Overall cost for comparison APR 52 APR. If a person. LoanAmount Rate 12 1 - 1 Rate 12 -Months.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. 510 Booking fee. Mortgage Interest Is Paid in Arrears.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

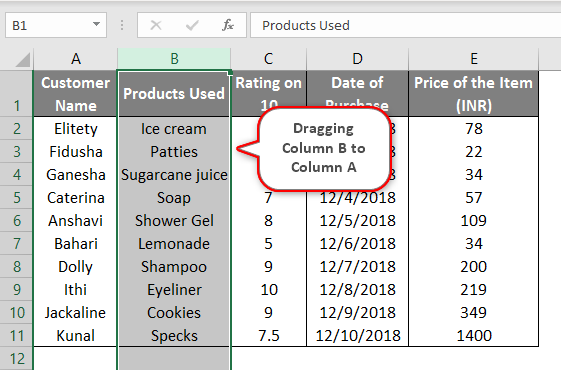

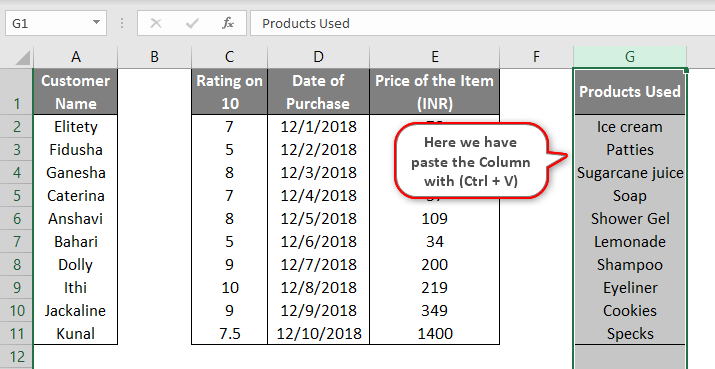

Switching Columns In Excel How To Switch Columns In Excel

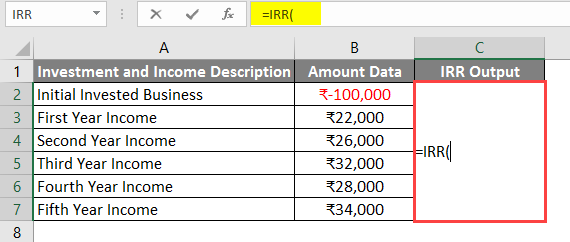

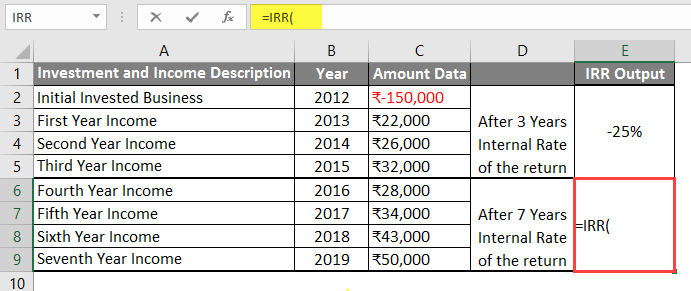

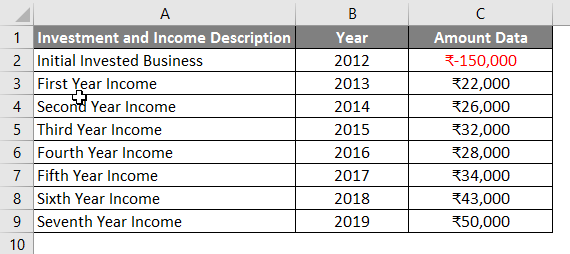

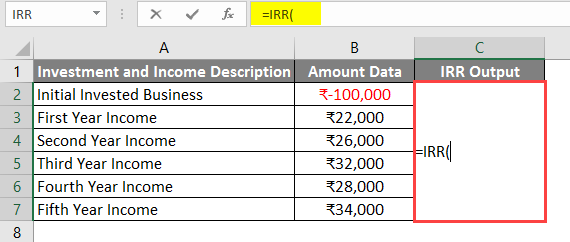

Excel Irr Formula How To Use Excel Irr Formula

Pin On Projects To Try

Switching Columns In Excel How To Switch Columns In Excel

Pin On Homes For Sale In Branson Missouri And The Surrounding Tri Lakes Area

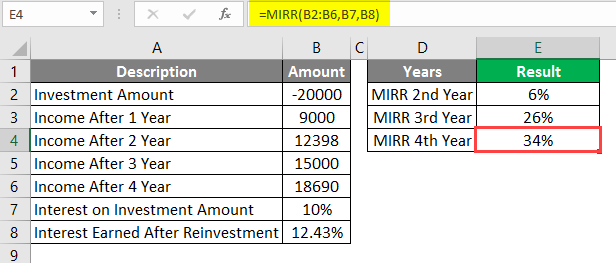

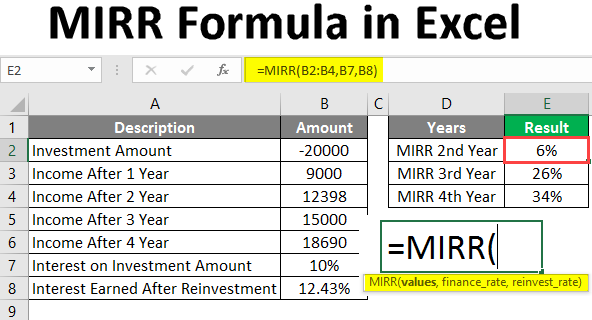

Mirr Formula In Excel How To Use Mirr Function With Examples

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Irr Formula How To Use Excel Irr Formula

34 Sample Budget Calculators In Pdf Ms Word

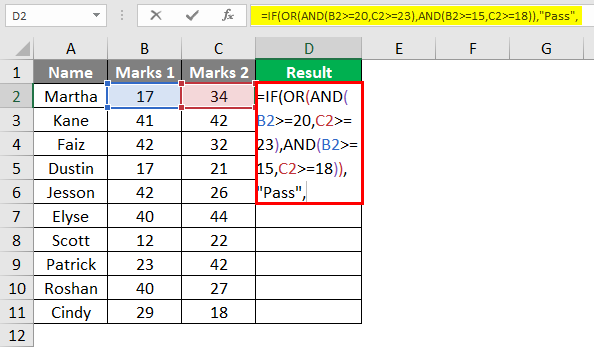

Excel Match Multiple Criteria How To Match Multiple Criteria In Excel

Tables To Calculate Loan Amortization Schedule Free Business Templates

7 Cancellation Letter Templates Letter Templates Free Letter Templates Letter Template Word

Mirr Formula In Excel How To Use Mirr Function With Examples

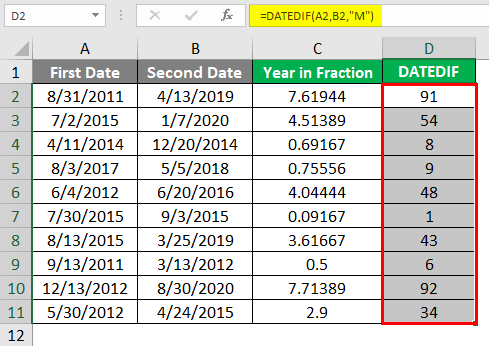

Subtract Date In Excel How To Subtract Date In Excel Examples

Excel Irr Formula How To Use Excel Irr Formula