Fha pre approval calculator

A seller often wants to see a mortgage pre-approval letter and in. FHA loans have lower credit and down payment requirements for qualified homebuyers.

Minimum Credit Scores For Fha Loans

All calculations and costs are estimates and therefore Guild Mortgage Guild does not make any guarantee or warranty express or implied.

. This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can qualify for. Higher ratios also require compensating factors for loan approval. The home you consider must be appraised by an FHA-approved appraiser.

Youll get a loan that covers both the purchase or refinance price and the. Be certain to ask your home mortgage consultant to help you compare the overall costs of all your home financing options. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration.

Credit score above 580 ok credit score from 500-579 require 10 downpayment. The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility. Results are based on a debt-to-income ratio of 43.

Calculator results do not reflect all loan types and are subject to individual program loan limits. But please understand its a calculator only and the official number will be determined by a mortgage lender. If you have equity in your current home your lender may offer a bridge loan to use while your new home is being built and youre waiting for your current one to sell.

For instance the minimum required down payment for an FHA loan is only 35 of the purchase price. Using our calculator above. A minimum of 500 preferably 580.

After pre-qualification you must obtain pre-approval. Calculator results do not reflect all loan types and are subject to individual program loan limits. Back-end ratio more important.

This a conditional guarantee from a lender to formally offer you a mortgage. Want to see if a specific condo complex is approved by the FHA. For borrowers interested in buying a home with an FHA loan with the low down payment amount of 35 applicants must have a minimum FICO score of 580 to qualify.

Making your payments on time is very important in the year ahead of your home loan application but. Going through the pre-approval process with several lenders allows a homebuyer to shop mortgage rates and find the best deal. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice.

September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt. In addition the validity of the results youll get from this mortgage prequalification calculator will. The FHA mortgage calculator includes additional costs in the.

If the condo development is not on the list or the approval has expired then the project would need to be approved or re-certified before an FHA loan can be obtained. Ideally 620 and up. Search the master list of FHA-approved condo projects.

You must occupy the property within. You can only get a new FHA loan if the home you consider will be your primary residence which means that it cant be an investment property or second home. General advice says that borrowers should come to the FHA home loan application process or any mortgage loan with a minimum of 12 months of on-time payments on all financial obligations including-and especially-payments for rent or a prior mortgage.

This calculator is offered for illustrative and educational purposes only and it is not intended to replace a professional estimate. This is an estimate only. However there is one exception.

Borrowers with poor credit scores limited downpayment. FHA loans are available with as little as 35 down. If you are seeking a loan for a format without a front-end limit.

An FHA 203k loan allows you to buy or refinance a home that needs work and roll the renovation costs into the mortgage. Essentially the federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments. There are certain requirements borrowers must meet to qualify for an FHA loan including.

Active duty military members veterans. Your debt-to-income ratio is calculated by adding up all of your monthly debt payments and dividing them by your gross monthly income. This can be an expensive somewhat risky situation since youre planning on your home to sell but it can help you get through a timing squeeze.

FHA loans have the benefit of a low down payment but youll want to consider all costs involved including up-front and long-term mortgage insurance and all fees.

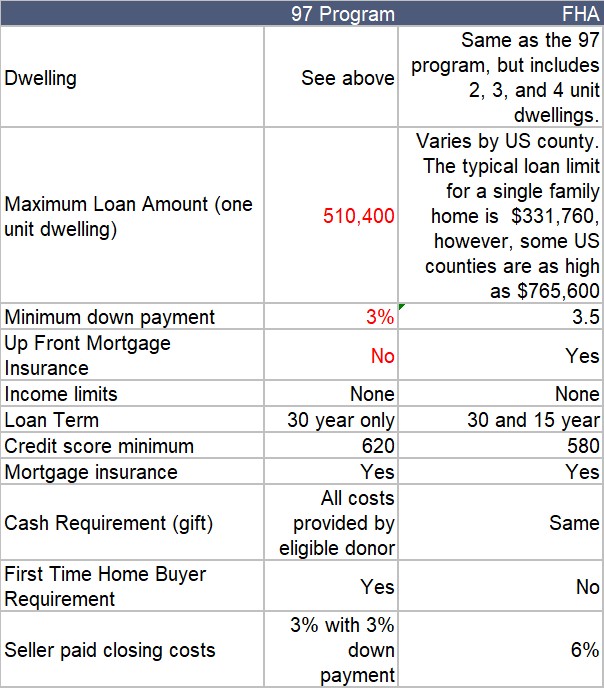

Usda Versus Fha Loan Program Comparison

Conventional 97 Loan And Calculator Anytime Estimate

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Usda Home Loan Qualification Calculator Freeandclear

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

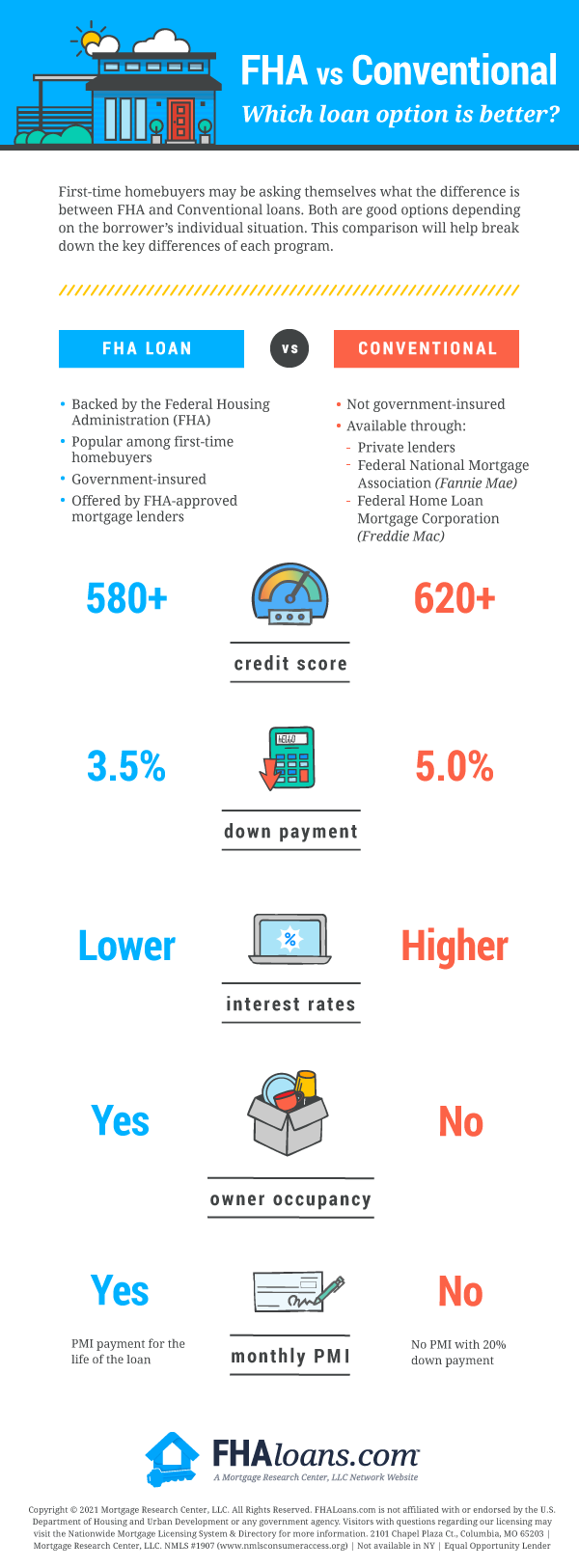

Fha Loans Vs Conventional Loans What S The Difference

Fha Loans Everything You Need To Know

Fha Vs Conventional Loan Is There A Difference

Fha Loan What To Know Nerdwallet

Fha Home Loan Mortgage Details Fha Mortgage Source

Fha Mortgage Rates Best Fha Home Loan Rates Programs

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

2022 Fha Qualifying Guidelines Fha Mortgage Source

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan With 1099 Income Fha Lenders